Accounting and procedures for petty cash

Petty cash accounting with definition, sample downloadable forms, sample journal entries, detailed example, and internal controls.

1. Definition of petty cash

Companies routinely make small purchases, which are not appropriate or practical for check or credit card payments. Examples of such purchases include stamps, supplies, travel expense, and delivery charges, among others.

To permit such purchases, companies establish a petty cash fund. The size of the fund depends on how much cash is spent on small purchases every two weeks to a month. The petty cash fund is set to be sufficient to cover expenses for that period of time. The fund normally ranges from $100 to $500.

Usually, one individual, called the petty cash custodian or cashier, is responsible for maintaining the petty cash fund and documentation of disbursements made and reconciling the petty cash fund at the time it is replenished.

A petty cash fund is cash in a secure lock box, which is used for small purchases and maintained by a petty cash custodian.

2. Journal entries and procedures for petty cash

Let's look at the journal entries and documentation used in working with a petty cash fund, and then we will review a detailed example.

2.1. Establish petty cash fund

The first time a petty cash fund is established a company writes a check to a designated petty cash custodian for the amount of the petty cash fund. The custodian cashes the check and puts the cash in a secure lock box. At the time the fund is created and petty cash is received, the following journal entry is made:

Account Titles |

Debit |

Credit |

Petty Cash |

000 |

|

Cash |

000 |

2.2. Disburse petty cash for expenditures

When a company employee spends some cash on small purchases (usually, with a prior approval by a manager), the employee brings the purchase receipt to the petty cash custodian. The custodian then disburses the amount of cash spent to the employee to compensate for the purchase. The custodian also fills out a petty cash voucher, asks the employee to sign it, attaches the purchase receipt to the voucher and places them in the secure lock box with the remaining petty cash.

Sometimes the employee who needs petty cash receives it from the custodian before making a purchase. In this case, the custodian fills out a petty cash voucher, asks the employee to sign it and gives necessary amount of cash to the employee as an advance. After the purchase is made, the employee brings back the purchase receipt and change. The custodian adjusts the original voucher to reflect the change received, attaches the purchase receipt to it and places both in the secure lock box with the remaining petty cash.

There are no journal entries at this point.

The petty cash vouchers serve as proof of cash spending or purchase advances to employees in case a manager or internal auditor makes an unannounced audit of the petty cash fund. The vouchers also serve as documentation showing what expenditures were made with petty cash and are used to prepare the petty cash journal when the fund is replenished.

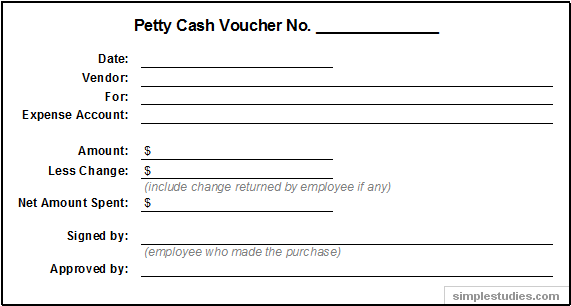

A petty cash voucher typically includes the following information:

- Voucher number

- Date

- Amount

- Expense account

- Vendor name

- Signature

A blank of a petty cash voucher is presented below (you can also download this MS Excel file for your use):

Illustration 1: Petty cash voucher example