What accounts are not closed at period end?

1. Definition of accounting period end

A company has transactions every day throughout the year. When the end of a period comes the company should "close the books."

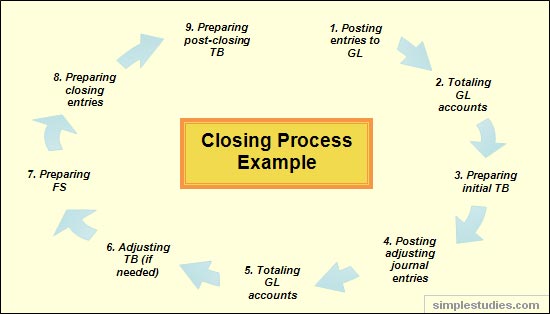

To prepare the financial statements at the end of an accounting period, a number of actions should be taken which represent closing the books. Closing the books process can be illustrated in the following way:

Illustration 1: Closing the books process

GL – General Ledger

TB – Trial Balance

FS – Financial Statements

The illustration above is one of the variations of the closing process. Depending on business needs, somewhat different versions of the closing process may be applied (not covered in this article).

2. Nominal accounts and real accounts

Nominal or temporary accounts are income statements accounts that are closed to Income Summary at the end of the reporting period.

Real or permanent accounts are balance sheet accounts which have a continuous nature and accumulate data from period to period; such accounts are not closed at the end of the reporting period.

Such a classification can be explained through the following statement: Balance sheet accounts are as of a certain date, while income statement accounts are for a certain period. In other words, balance sheet accounts present information as of a balance sheet date whereas the income statement accounts present information accumulated during a period.

Nominal or temporary accounts may include but are not limited to:

- revenue accounts

- cost of goods sold accounts

- administrative expenses accounts

- selling expenses accounts

- other income statements accounts

Real or permanent accounts may be represented by the following accounts:

- cash

- accounts receivable

- allowance for doubtful accounts

- inventory

- prepaid insurance

- accounts payable

- accrual liabilities (expenses)

- owner's equity

- other balance sheet accounts

Nominal or temporary accounts are closed in the following way:

- The credit accounts (i.e. revenue accounts) are closed by making a debit entry to the account and a credit entry to Income Summary.

- The debit accounts (i.e. expense accounts) are closed by making a credit entry to the account and a debit entry to Income Summary.

The income and expense account balances are transferred to a new temporary account – income summary.

Income Summary Balance = Sales – Expenses |

The balance in the Income Summary account is then transferred to Retained Earnings. Retained Earnings is a line shown within the Owner's Equity (Shareholder's Equity) section of the balance sheet.

3. Example of closing entries

To understand these concepts better, let us look at the example below:

At the end of the accounting period a company has the following data:

Revenue = $1,750

Expense = $1,500

To close these temporary accounts, the company makes such entries:

Account Titles |

Debit |

Credit |

Revenue |

1,750 |

|

Income Summary |

1,750 |

Account Titles |

Debit |

Credit |

Income Summary |

1,500 |

|

Expenses |

1,500 |

Finally, the balance in the Income Summary account of $250 (i.e. $1,750 - $1,500) is transferred to Retained Earnings:

Account Titles |

Debit |

Credit |

Income Summary |

250 |

|

Retained Earnings |

250 |

The company's net income for the period was $250.