Manufacturing and Nonmanufacturing Costs

Manufacturing (direct materials, direct labor, factory overhead) and non-manufacturing costs; product and period costs; raw materials, work-in-process and finished goods; cost of goods manufactured and cost of goods sold; cost accounting cycle.

1. Introduction to manufacturing and nonmanufacturing costs

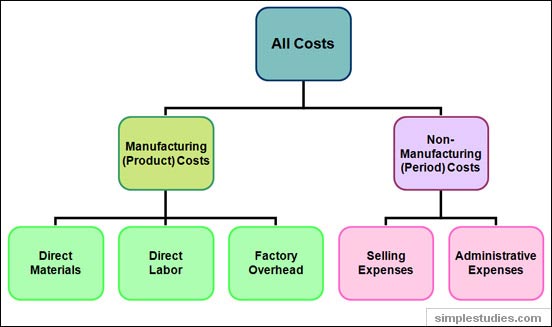

A manufacturing company incurs both manufacturing costs (also called product costs) and nonmanufacturing costs or expenses (also called selling and administrative expenses). In the illustration below you can see the difference between manufacturing and nonmanufacturing costs and their classification:

Illustration 1: Manufacturing vs. nonmanufacturing costs

Let us review these types of manufacturing and nonmanufacturing costs in more detail.

2. Manufacturing costs and their classification

Manufacturing costs are the costs that a company incurs in producing a product.

From the managerial accounting standpoint, there are three types of manufacturing costs:

- Direct materials

- Direct labor

- Factory (or manufacturing) overhead

2.1. Direct materials as a type of manufacturing costs

Direct materials are raw materials that become an integral part of the finished goods.

Direct materials should be distinguished from indirect materials (part of overhead costs), about which we will talk later.

Direct materials always have a variable nature. Recall from other tutorials that variable costs change in proportion to production. For instance, in our example of Friends Company, the company purchases metal parts (raw material) to produce valves. The more valves are produced, the more parts Friends Company has to acquire. Therefore, parts have a variable nature; the amount of raw materials bought and used changes in direct proportion to the amount of valves created. For Friends Company, other direct materials would include, for example, plastic parts and paint.

Different manufacturing companies will have different direct material costs depending on the types of finished goods they produce. The table below provides a few examples:

Illustration 2: Examples of direct material costs

Examples |

Direct Materials |

Publishing company |

Paper, ink, book covers |

Automobile manufacturer |

Tires, automobile metal parts |

Computer manufacturer |

Hard drives, monitors |

From the table you can see that direct materials are the integral part and a significant portion of finished goods.