Intercompany transfer pricing: calculation methods and examples

Transfer pricing is an important topic for top management, accounting and finance departments, and financial auditors, especially among multinational corporations. Transfer pricing is important for at least two reasons: performance evaluation of business units or segments; and tax strategy. There are several methods that can be used to calculate an optimal transfer price. In this tutorial, we review these methods and provide examples.

1. Transfer pricing calculation methods

Transfer pricing is the process (methodology, policy, procedures) of determining the price at which goods or services are exchanged internally between affiliates or divisions of an organization.

Important to note, transfer pricing does not affect the total organizational net income (except for tax liabilities in multinational corporations), but it affects individual business unit performance. Transfer price is revenue for one internal division and cost for another internal division. At the net, the transfer price is cancelled out when business unit results are aggregated at the company level.

It is important, nevertheless, for an organization to get transfer pricing right because it impacts the achievement of strategic goals, establishes proper level of autonomy for divisions of a company, helps create appropriate incentives or motivation for managers, and ensures cost efficient resource allocation.

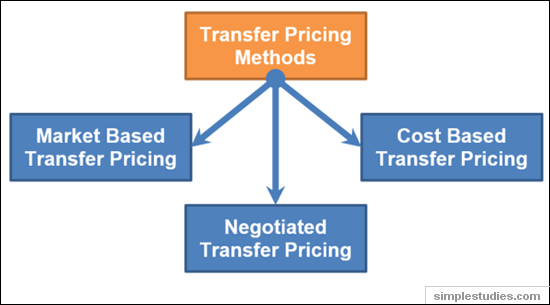

There are several transfer pricing methods:

Market-based transfer pricing. Under this method, the intercompany prices are established by reference to the market (e.g., at what prices external vendors sell respective products or services).

Cost-based transfer pricing. This method uses internal cost data to establish transfer pricing. There are multiple ways of using costs when applying this method (e.g., variable cost only, variable and fixed cost, variable cost + margin).

Negotiated transfer pricing. This method is applied when there is no clear external market-based pricing and cost-based transfer pricing is not possible. The selling and buying division of a company negotiate the transfer prices.

Each method has its own advantages and disadvantages. Ultimately, it is top management’s responsibility to determine the best transfer pricing method(s) and formula(s) to achieve desired effects of internal exchange between company divisions.

Let’s take a look at each method in more detail using the following example:

Company ABC has three divisions: D1, D2 and D3.

Division D3 requires a widget and can buy it from an external vendor or Division D1.

External vendor price (per widget) = $150.

Division D1’s variable cost (per widget) = $70.

Division D1’s fixed cost (per widget) = $30.

Division D1’s total cost (per widget) =$100.

Division D1 can sell the widget to an external customer for $150.

Division D1 has idle capacity. The sale of widgets to D3 will not impact Division D’s normal sales to external customers.

Note: in this article we are not discussing the use of transfer pricing methods for a tax strategy (e.g., in multinational corporations).