What are retained earnings?

Learn about retained earnings and how retained earnings are determined.

1. Definition of retained earnings

As the name suggests, retained earnings represents income that was retained (i.e., kept, accumulated) by the company. Retained earnings represent one of the stockholders’ equity accounts: that is, retained earnings are reported on the balance sheet – as well as the statement of stockholders’ equity.

If retained earnings represent retained income (or loss, if negative), why it is not reported on the income statement? Remember, the income statement (also called, statement of earnings) shows the results of operations of a particular accounting entity for a particular period of time (e.g., this fiscal year) while the balance sheet (also called, statement of financial position) shows the financial condition of the entity as of a particular date. As retained earnings represent accumulated income as of a particular date, it makes sense to report retained earnings on the balance sheet.

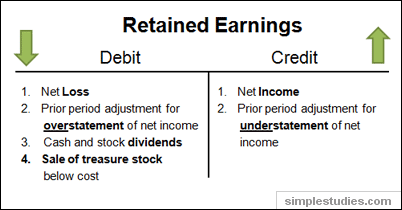

Importantly, retained earnings link the balance sheet to the income statement: net income increases retained earnings while net loss decreases retained earnings. Retained earnings are affected by net income (loss), cash and stock dividends, prior period adjustments for overstatement or understatement of net income, and disposal of treasury stock below cost (see Illustration below):

The normal balance in retained earnings is credit: that is, retained earnings increase when credited and decrease when debited. A debit balance in the retained earnings account is called a deficit.

In some jurisdictions, incorporation laws prohibit companies from paying dividends when there is a deficit balance in the retained earnings account. There are accounting procedures that can be used to eliminate the deficit. For example, a company might be able to reclassify the deficit (e.g., decrease additional paid-in capital and increase retained earnings up to the zero balance) or eliminate the deficit through an accounting reorganization (e.g., write-up an asset or write-down a liability to its fair market value).

In general, changes in retained earnings can be reported in:

- separate statement of retained earnings (see the following example)

- statement of stockholders’ equity

- combined income and retained earnings statement