What does indorsement mean?

Indorsements (endorsements) and their kinds.

1. Definition of indorsement, indorser, and indorsee

Note: This article should be used for information purposes only. Please consult your attorney or other professionals regarding specific applications of rules related to indorsements (also refer to Simplestudies.com disclaimer).

Indorsement (endorsement) is a signature on a negotiable document (e.g., check) which gives a right to use or fulfill the document (e.g., to cash, to deposit, to pay).

The person or entity who writes his/her name on an indorsed document is called an indorser, and the person to whom it is signed is called an indorsee.

2. Different kinds of indorsements

There are different kinds of indorsements depending on whether there is additional information along the signature on a negotiable document. Let us look at the characteristics of different kinds of indorsements using check as an example. In this case the check is a negotiable document. Note that checks are indorsed by signing them and, optionally, putting additional words or language on their back side.

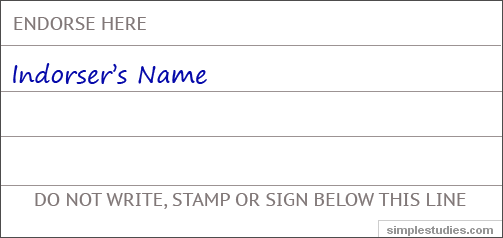

Blank or general indorsement is the simplest kind of indorsement. It only contains a signature of the indorser and does not indicate the indorsee. There are no additional words or language. That is why this indorsement is called a blank indorsement. See below for an example of such indorsement:

It is sufficient to have the indorser’s signature to cash or to deposit such a check. Thus, a correct blank indorsement makes a check cashable. On the other hand, it becomes a risky instrument because in the case of theft or loss, the check can be cashed by any person. It will not be a problem if you adhere to one simple rule: sign a check only before cashing it.

For example, if Marry Smith signs a check payable to her order with her name on the back of the check, the check becomes indorsed in blank. This check can be deposited in a bank account, transferred to another person, etc.

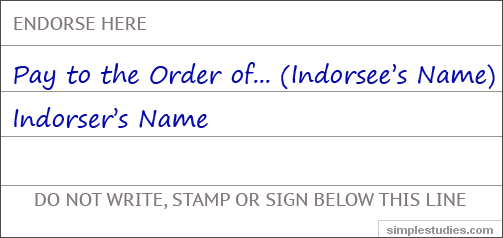

Special or full indorsement consists not only of a signature of the indorser but also words indicating to whom, or in whose order, the check is payable (i.e., indorsee). Nobody besides the indorsee can use or fulfill the check. That is why this type of indorsement is safer than a blank indorsement. See below for an example of such indorsement:

There may be one or more indorsees on a check with a special indorsement. In the case of multiple indorsees, one or all indorsees will need to sign the check to negotiate (e.g., transfer) it, depending on what relationship (and, or, or just commas) was used with the indorsees’ names when the check was initially indorsed (signed). All indorsees need to sign the check if their names are connected with an and. Either indorsee needs to sing the check if their names are connected with an or. In case the indorsees’ names are listed with commas it is assumed that an and was used and all indorsees need to sign the check to negotiate it.

For example, Marry Smith signs a check made payable to her order as “Pay to the Order of John Doe and Anna Vermont.” Both John and Anna will have to sign the beck if they want to deposit it in a bank account. On the other hand, if Marry signs the check as “Pay to the Order of John Doe or Anna Vermont,” then either John or Anna will have to sign the check to deposit it.

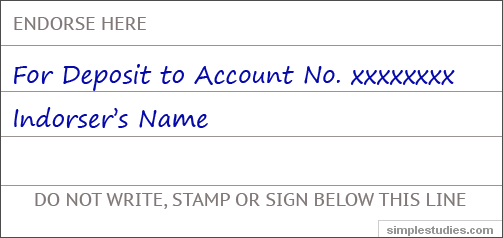

Restrictive indorsement, besides a signature of the indorser, has information about how to negotiate a check. For instance, a restriction such as “For Deposit Only” allows to deposit, but not to cash, a check. It is convenient and safe to use this type of indorsement if you mail the check. See below for an example of such indorsement:

For example, Marry Smith signs a check made payable to her order as “For Deposit to Account No. 12345678.” This indorsement will only allow depositing this check into the named bank account.

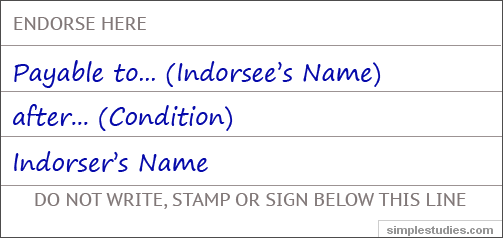

Conditional indorsement, besides a signature of the indorser, has information about an action that has to be done to negotiate this check. For instance, a condition such as “Payable to … (Indorsee’s Name) after the building is constructed” means that the indorsee will receive his/her money only after this condition is fulfilled. See below for an example of such indorsement:

It is important to note that this type of indorsement is not typically accepted by financial institutions because of impossibility to verify performance of the condition.

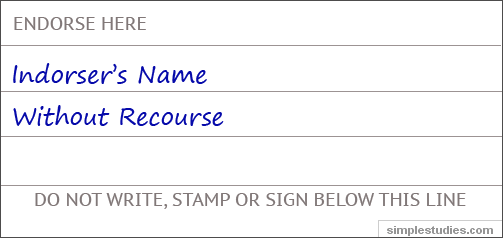

Qualified indorsement relieves the indorser from the liability of making a check good if the check maker defaults on it. Wording "Without Recourse" (along with the indorser’s signature) on the back of a check prevents it from returning to the indorser for any reasons. See below for an example of such indorsement:

Also note that this type of indorsement is not accepted by financial institutions because of the limitation of the indorser’s liability.

3. How to make an indorsement on a check

Let us look at the steps that need to be taken to properly indorse a check:

- Turn the check over.

- Find an indorsement area which is a space between the two lines called ENDORSE HERE and DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE.

- Decide what type of indorsement is appropriate in your situation and write the corresponding words (refer to different kinds of indorsements above). Depending on your needs, it can be a combination of indorsements.

- Put your signature.

The indorser should adhere to the following rules to help avoid potential problems with a check negotiation:

- Sign the name exactly as it is written on the front of the check.

- Be careful, do not hurry to sign a blank indorsement.

- When indorsing a business check write the following: Company, Your name, and Position in the company.